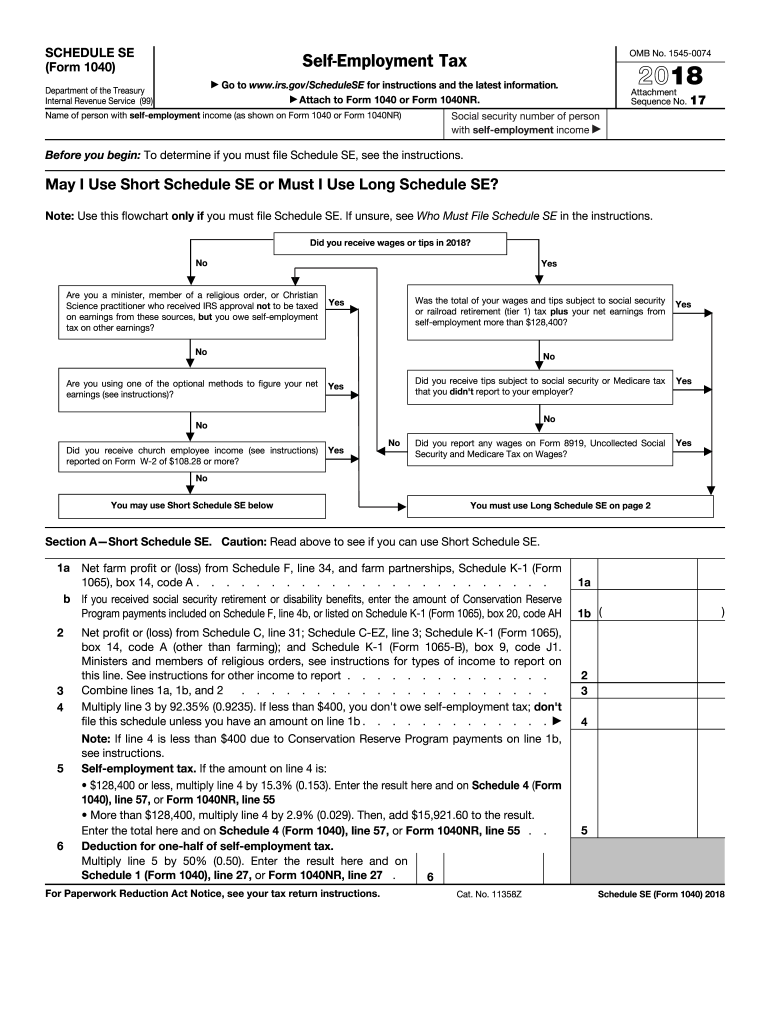

You received distributions from a foreign trust. You’re repaying the first-time homebuyer credit. Your employer didn’t withhold Social Security and Medicare taxes from your pay. You’re eligible for the premium tax credit. Tips you didn’t report to your employer. You must file a Form 1040 if you have any of these:

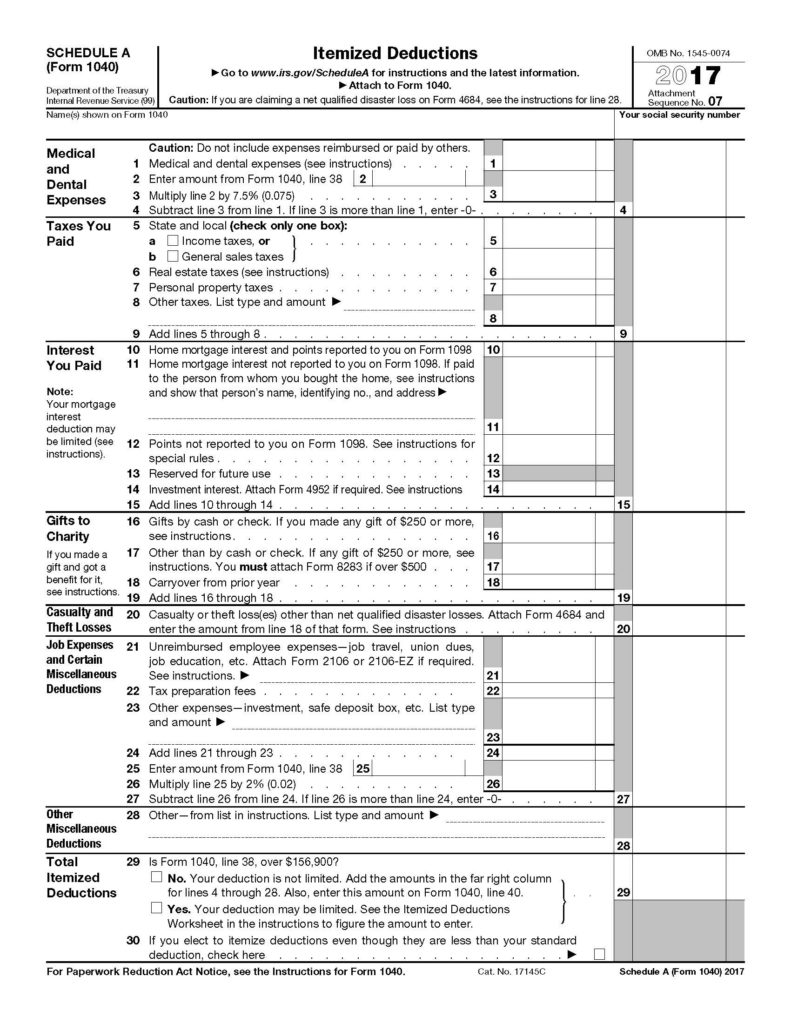

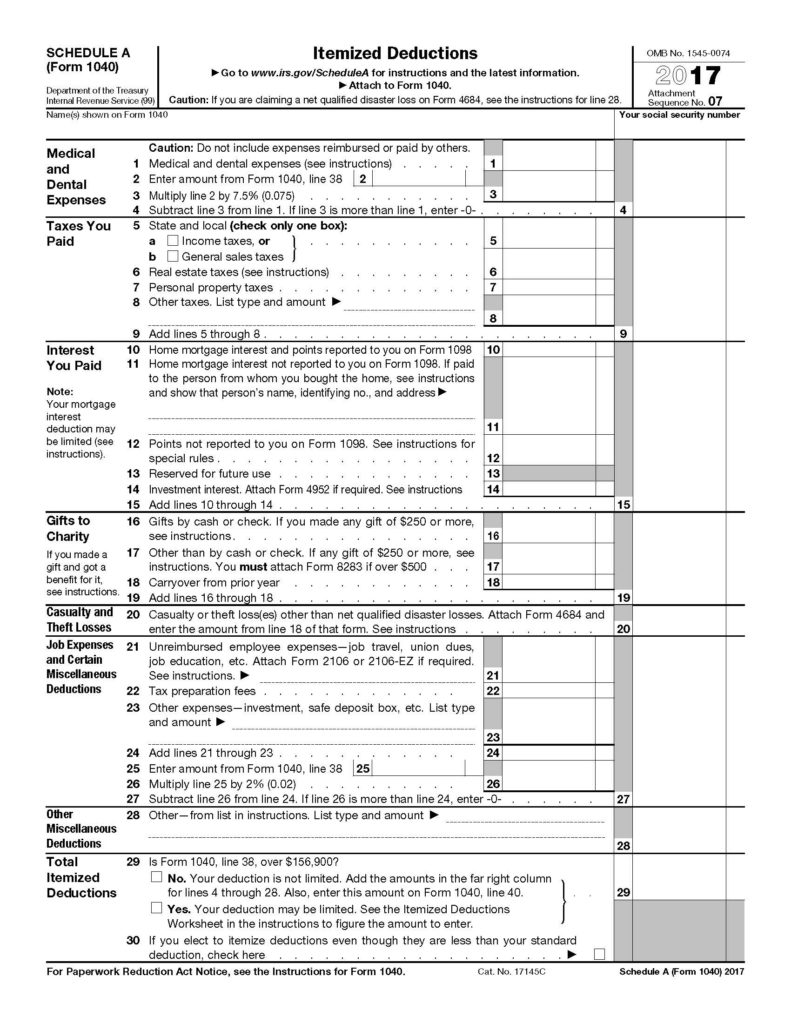

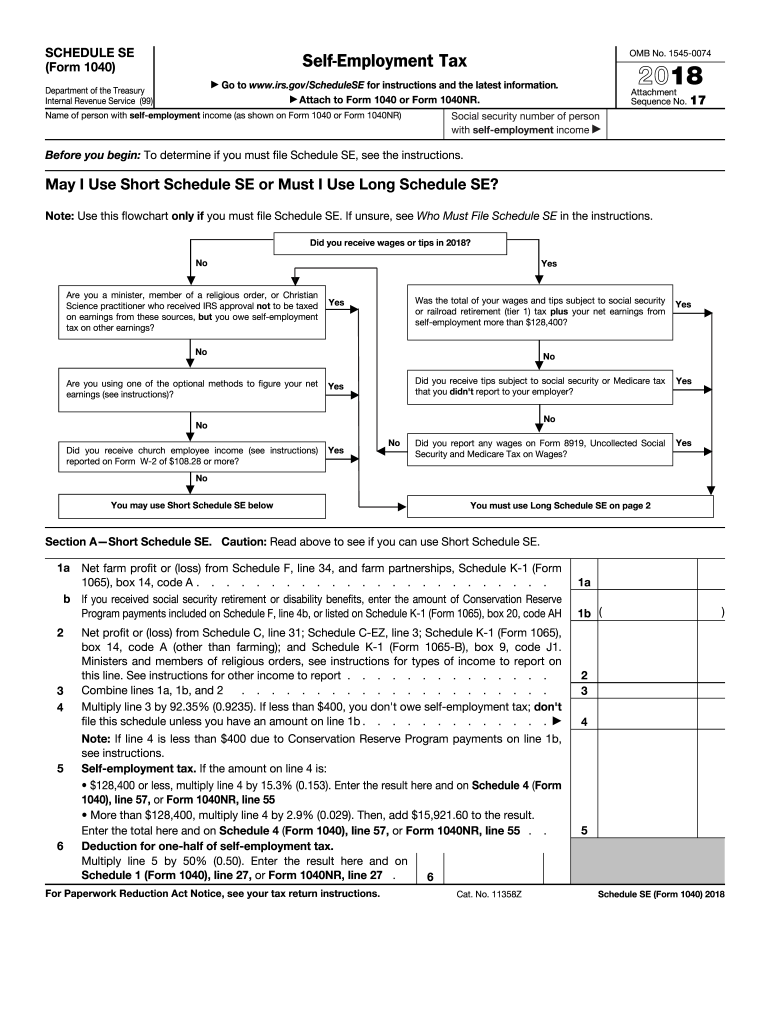

You received distributions from a foreign trust. You’re repaying the first-time homebuyer credit. Your employer didn’t withhold Social Security and Medicare taxes from your pay. You’re eligible for the premium tax credit. Tips you didn’t report to your employer. You must file a Form 1040 if you have any of these:  You owe excise tax on insider stock compensation you got from an expatriated corporation. You’re claiming the Adoption Credit or you received employer-provided adoption benefits. You had a qualified health savings account (HSA) funding distribution from your IRA. You have a loss attributable to a federally declared disaster area. You’re reporting an original issue discount (OID) amount that doesn’t match the amount on Form 1099-OID. Interest you received or paid on securities that were transferred between interest payment dates. Insurance policy dividends that are more than the premiums you paid. If you receive these types of income or losses, you may need to file a 1040 tax form: If you e-file your return, you generally won’t notice much of a change and the software will generally determine which schedules you need. See the 1040 instructions for the schedules for more information. Below is a general guide to which schedule(s) you will need to use based on your circumstances. However, if your return is more complicated (for example, you claim certain deductions or credits or owe additional taxes), you will need to complete one or more of the new numbered schedules.

You owe excise tax on insider stock compensation you got from an expatriated corporation. You’re claiming the Adoption Credit or you received employer-provided adoption benefits. You had a qualified health savings account (HSA) funding distribution from your IRA. You have a loss attributable to a federally declared disaster area. You’re reporting an original issue discount (OID) amount that doesn’t match the amount on Form 1099-OID. Interest you received or paid on securities that were transferred between interest payment dates. Insurance policy dividends that are more than the premiums you paid. If you receive these types of income or losses, you may need to file a 1040 tax form: If you e-file your return, you generally won’t notice much of a change and the software will generally determine which schedules you need. See the 1040 instructions for the schedules for more information. Below is a general guide to which schedule(s) you will need to use based on your circumstances. However, if your return is more complicated (for example, you claim certain deductions or credits or owe additional taxes), you will need to complete one or more of the new numbered schedules.

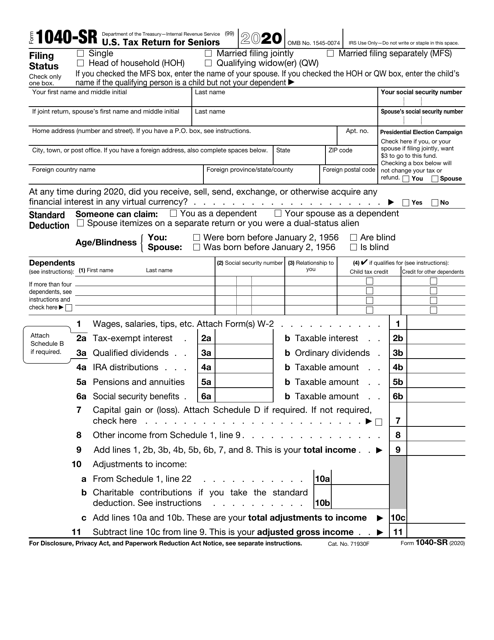

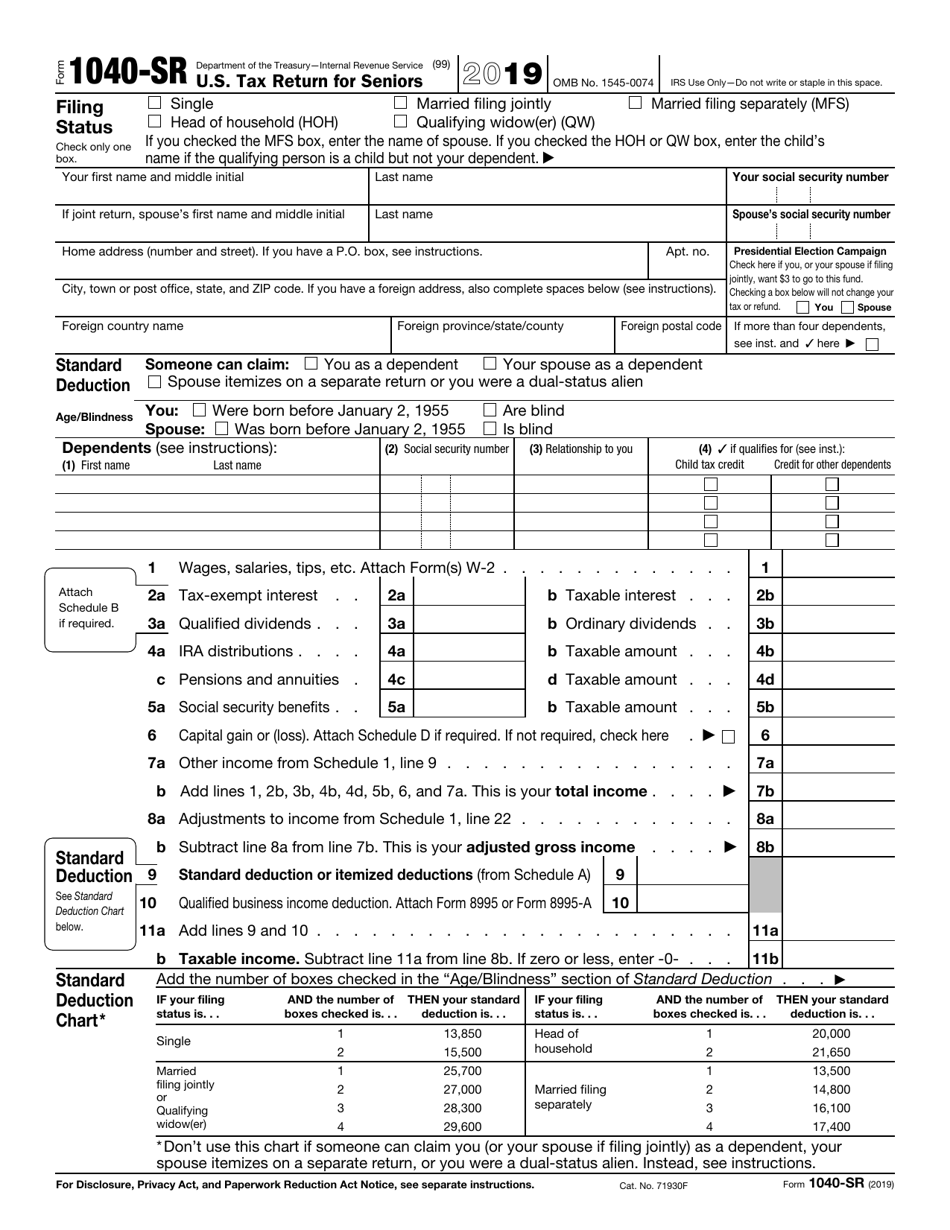

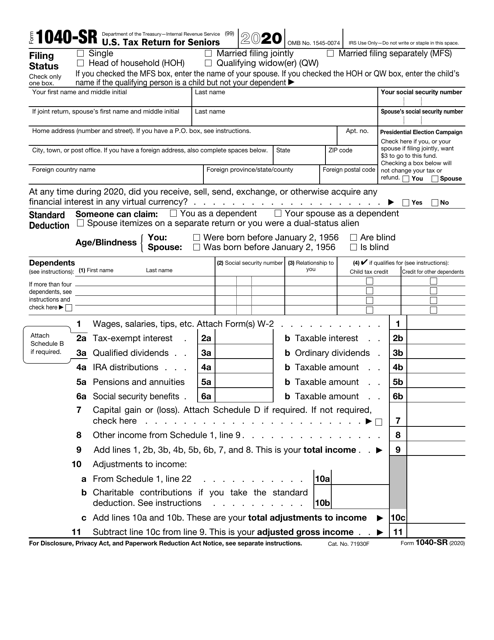

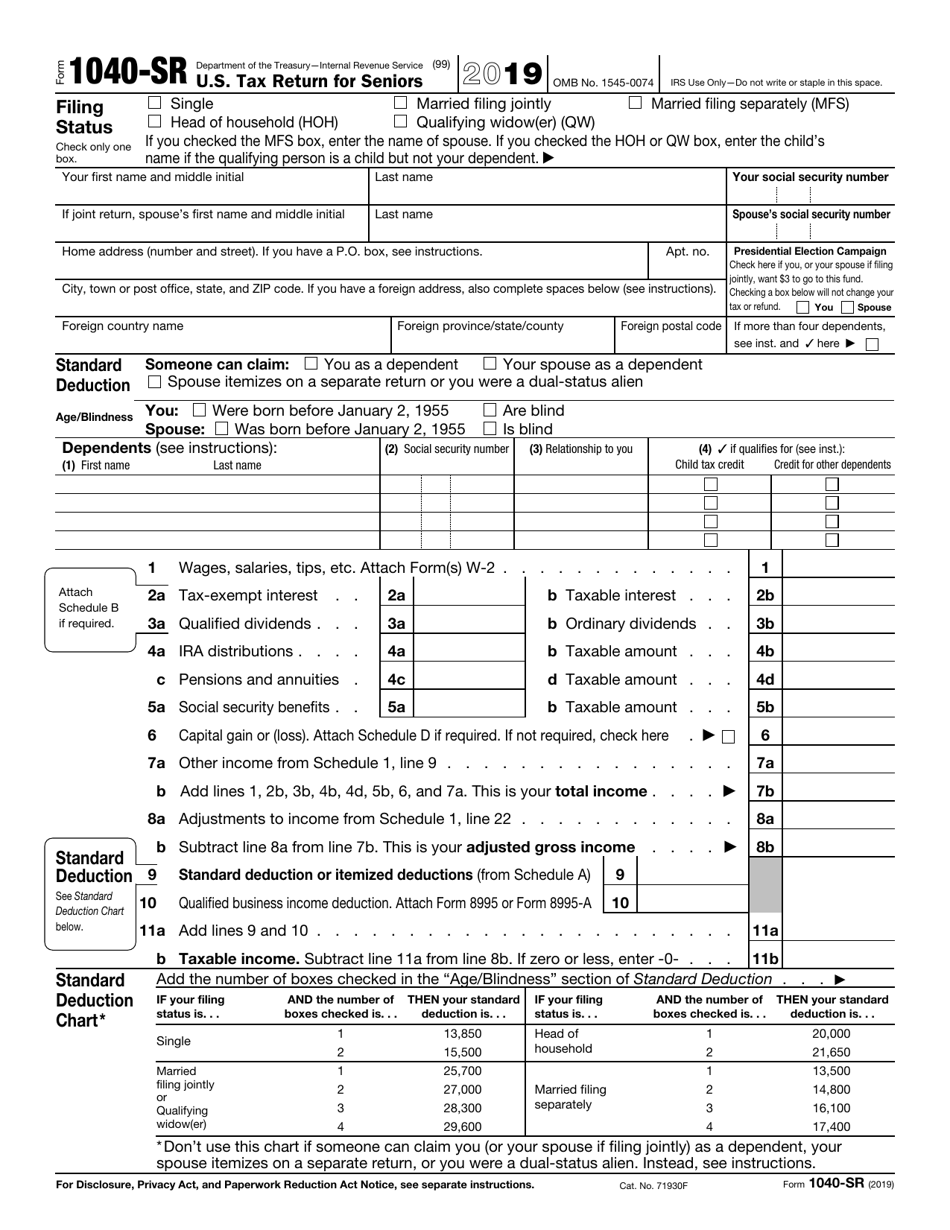

Many people will only need to use Form 1040 and none of the new numbered schedules. You will use the redesigned Form 1040, which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Here are the new 1040 form instructions as of 2019 from the IRS: Previously, the IRS offered different types of Form 1040 – the 1040A and 1040 EZ.

With a Form 1040, you can report all types of income, expenses, and credits.

0 kommentar(er)

0 kommentar(er)